The 2020 industrial development market hot streak is looking like it has no plans to slow down as we approach the end of 2021 Q1.

From their respective offices in Indianapolis, Kansas City and Minneapolis, Doug Swain, vice president and general manager with The Opus Group, Grant Harrison, director of development with VanTrust Real Estate, and Tim Elam, managing director with Scannell Properties, joined moderator Chris Gutierrez, president of KC SmartPort, for a discussion of the industrial real estate market from a local, regional and national prospective.

The virtual event on Friday, March 19, was hosted by CCIM Kansas City.

Gutierrez opened the discussion by announcing that 2020 was a record year for attracting new industrial development to the region. Twelve new companies came into the market bringing almost $1 billion in capital investment. These companies represented e-commerce, food and beverage, regional distribution projects and manufacturing.

“I think I’ve seen statistics from some of the brokers on this call that we pushed 16 million SF last year of new industrial, whether that was spec or build to suit. . . . It looks like 2021 is going to stay right on track, maybe beat that number,” said Gutierrez.

Swain said the success of the industrial market is attracting new equity partners who have not been in the industrial space before. Opus, who sells all projects it builds and stabilizes, continues to see strong sales interest in all of its stabilized product.

Harrison said that in 2020, VanTrust started projects totaling close to $800 million, primarily focused around industrial. He predicts that this pace will continue this year and next.

Harrison said VanTrust will be delivering to the Kansas City region a 640,000-SF spec building located near Kansas City International Airport, a 560,000-SF industrial project in Raymore and a 150,000-SF build to suit facility for Pretzels, Inc. in Lawrence, Kan. He said VanTrust continues to look for build-to-suit and land opportunities in the Kansas City region.

Elam said Scannell had its best year in 2020, starting projects totaling 21 million SF, mostly industrial. Scannell Properties, a privately owned and funded developer based in Indianapolis, entered the Kansas City market within the past two years.

In 2020, Scannell purchased the horse and dog racing track formerly known as The Woodlands located in Kansas City, Kan. Scannell is constructing a build-to -uit facility for Amazon of approximately 1.1 million SF on the site. Scannell also plans to construct a 456,000 SF spec facility on the site.

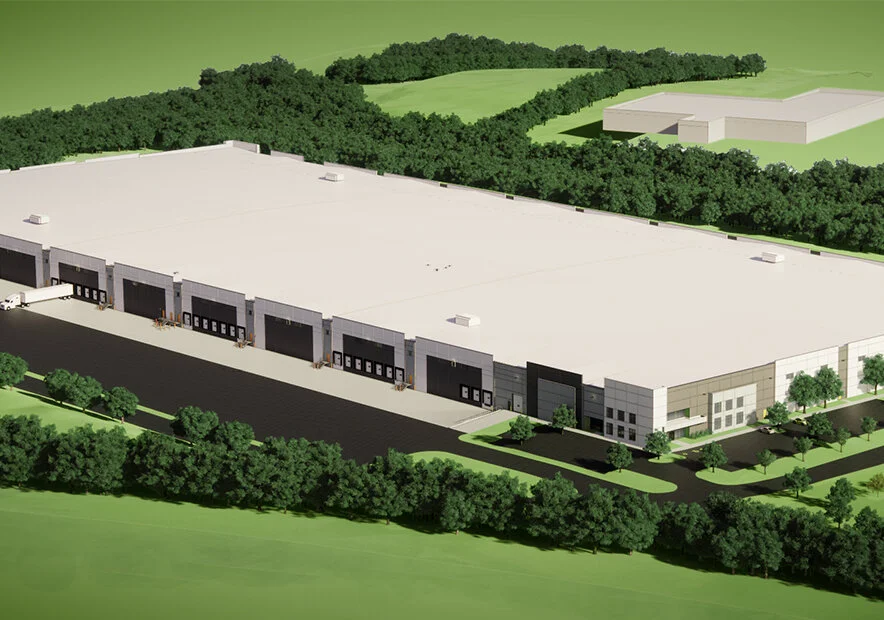

In addition, Scannell is developing Compass Logistics Park in Bonner Springs, Kansas, with plans to deliver 627,000 SF in the second quarter of 2022, and I-35 Logistics Park in Olathe, Kansas, on which it plans to break ground in mid-April for a 563,000 SF, 36 foot clear double load facility.

“We’re in the market. We’re trying to build our land positions. When we come into a market, our strategy is trying to be active in each submarket,” said Elam.

All panelists said that tenant demand for industrial space is strong, especially for well-located properties. But, finding that ideal property is getting difficult.

“It’s harder to find land sites in opportune locations. Those land sites are increasing in price,” said Swain.

The panelists said one of the biggest challenges they currently face is the rising price of steel and its scarcity. Elam said that the price of steel is up $3.00 per SF on an industrial box over what it was just nine months ago. And, in many markets, delivery of steel is delayed until early 2022. These delays can make or break a project.

“It gets real hairy depending on how your leases and build to suit structures work, but there’s a lot of exposure out there right now,” said Harrison.

Harrison said rental rates on industrial properties began to rise last year. He predicts they will continue to rise this year as well.

The panelists said there is an increased demand for cold storage across the country from a variety of users, although it’s a very difficult product to develop speculatively. Elam and Harrison said when they develop speculatively, they delay installing the floor as long as possible before committing to go cold storage or not.

“I’d add that even pre-COVID, the supply of cold storage averages 35 to 40 years old across the country. So there was a need to modernize it. And now with the demand of fresh and frozen food, the buzz is real,” said Harrison.