FEATURE PHOTO CREDIT: RUTH THALER-CARTER | MWM STL

SkyView Partners and Tegethoff Development team with Marriott for Oasis at Lakeport expansion

Innovation and customer experience key to St. Louis commercial real estate growth in 2023

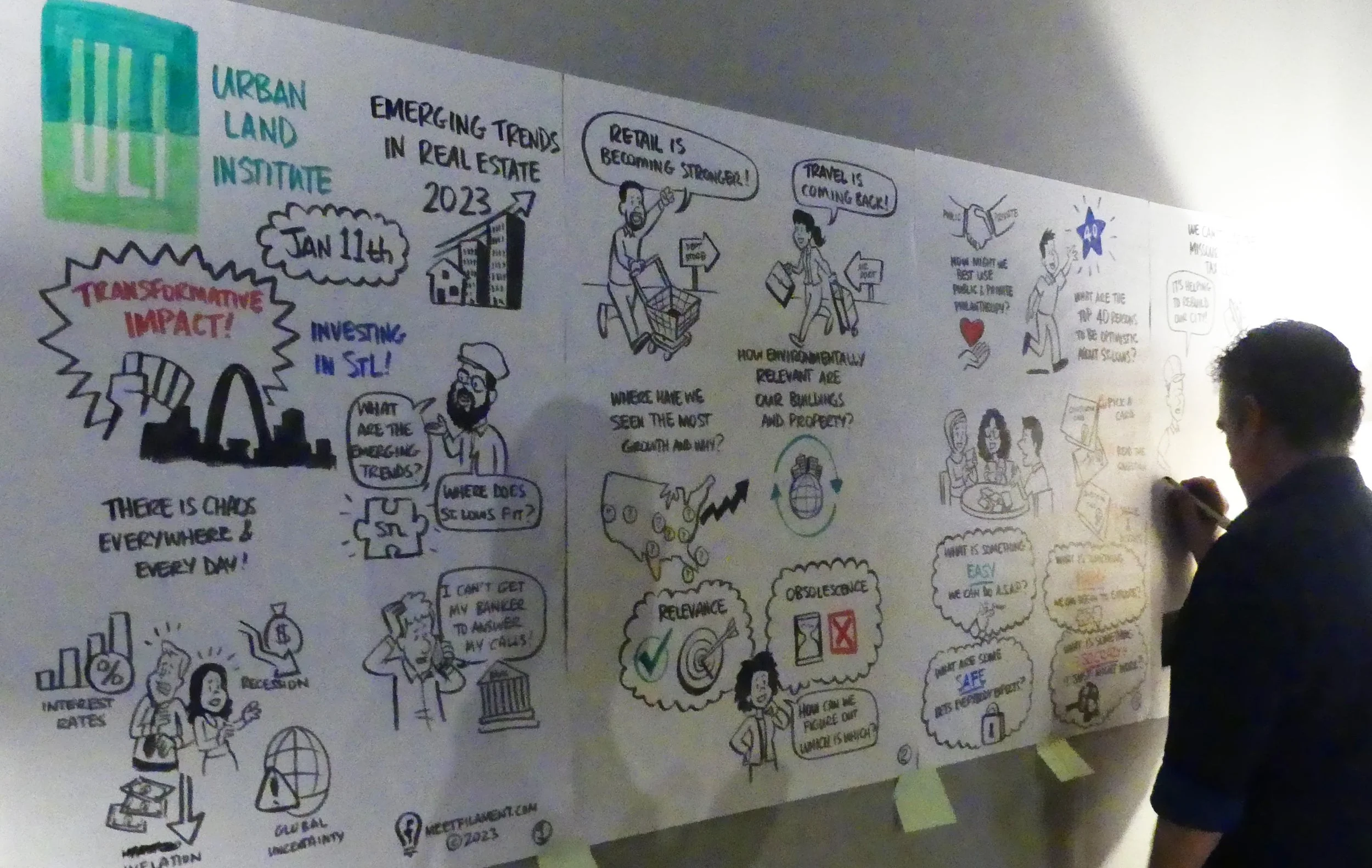

More than 100 industry professionals attended MetroWire Media's 2023 Market Forecast Summit on March 9, 2023 at the Lodge Des Peres, which featured networking and a panel discussion with Addie Bunting from Wies Offsite as the moderator, and panelists Lauren Talley with Cobalt Construction Consulting, Tom Ray with CBRE, Tom Kaiman with Mia Rose Holdings, and Kyle Wilson with Kadean Construction. The panelists covered a range of CRE topics related to multifamily housing, office, industrial, and retail real estate.

Here are some highlights from the session:

Impact of the new Citypark Soccer Stadium

Kaiman: “It’s a great addition to the city that will spur other development in the area. Quality developments will bring people back to town. It will be an exciting place to live. The Taylor family is doing a great thing with this investment in the city.”

Talley: “It is exciting to see midtown coming to life,” said Talley. “Out-of-town developers are coming in.”

Multifamily

Kaiman: “Multifamily has been undersupplied for decades; zoning, permitting and NIMBY continue to be problematic. A lot of new product is coming online in St. Charles County.”

Wilson: “We continue to see a lot more interest in multifamily and condo properties for sale among empty nesters in Kirkwood, Webster Groves and Clayton. Small projects seem to infill well.”

Ray: “Apartments will fix downtown. The answer is more apartments. It’s more important than ever that people can live in walking distance of their offices.”

Talley: “Multifamily has exploded. The result is a flight to quality while commercial is seeing a flight to amenities.”

Office

Ray: “Downtown is seeing a nice absorption in startup and early-stage businesses looking for office space needing little improvement. Landlords are ready to deal. There’s an historic view that the prime downtown tenant is a large law firm that will stay forever, but smaller startup companies are the future. There’s a lot of leasing as companies look for smaller office space.”

Kaiman: “There’s no longer a playbook or one size fits all. We’re still trying to figure it out. The world will continue to evolve in how we work, how we live, how we play.”

Retail

Kaiman: “Development fits everywhere. It’s all about how you activate a site and bring people there. It has to be safe. Cities that keep an open mind will benefit. The economic development folks have to be out there recruiting for new businesses.”

Wilson: “Store chains are taking a new approach, adding a smoothie bar, clothing for sale, etc., to create a new experience.”

Ray: “Mixed use is a goldmine for commercial/retail. It’s completely based on walkability.”

Talley: “Mixed use is kind of the ‘new black,’ and jurisdictions are mandating it. I think it’s here to stay. We need to grow to be more welcoming to national chains.”

Cannabis

Kaiman: “It’s the best thing that ever happened to empty stores. Data also shows property values going up around dispensaries.”

Industrial

Wilson: “We’re finding more mega-sites — they seem to be bigger and bigger. Tenants who need smaller space might be left in the dust. Big is booming.”

Talley: “We have the land available (that companies need for large industrial uses). Cost increases for materials and supplies led to a pause. Products delivered to the home with continue to grow (and require large warehouse and distribution facilities). Companies are looking to automation because it offers less human error or possibilities of people getting hurt — all industries are increasing automation.”

Wilson: “Automation has much higher construction requirements, so we’ll see taller buildings. If it gets traction, it will change the way we build warehouses.”

What Clients Want

Kaiman: “Our customers are tenants, so the flight to quality is their number-one driver.”

Wilson: “Our biggest challenge is being asked for more product. The subcontractor market is overloaded — they need more workers.”

Ray: “The collective experience in the office sector is adding more amenities. A new building has to be different from the one next door. You have to figure out how to provide experiences.”

Talley: “Clients want transparency in everything — costs, where products are coming from, when items will arrive, whether prices will be the same on arrival.”

Overall, the panel was optimistic about the future of commercial real estate in St. Louis, highlighting the potential for growth and expansion across all four sectors. They emphasized the importance of providing customers with unique experiences, as well as the need for economic development teams to recruit new businesses to the area.

_____________________________________________

Innovative partnership brings life to St. Louis' Grove Neighborhood

TCARE's expansion includes prime location on dedicated bike lane

FEATURE IMAGE: The Tower Grove Connector, a 1.4-mile dedicated bike lane, will run directly in front of TCARE's new facility on Vandeventer Ave. in St. Louis' Botanical Heights neighborhood, providing new infrastructure to further connect city neighborhoods. Image credit: Tower Grove Connector/www.towergroveconnector.com.

Cool conversions, higher purposes among emerging real estate trends

Architects provide key ingredients for restaurant success

Panelists chime in on 2023 AEC economic predictions

Unique amenities, pre-planning play key roles in mixed-use success stories

Expo at Forest Park takes transit-oriented development to next level

Area airport directors say regional collaboration is key to growth for all

Trolley tour explores game plan for Midtown St. Louis

Brinkmann Constructors promotes Brian Satterthwaite to CEO, Tom Oberle to president

Brinkmann Constructors has completed a leadership succession plan that promotes Brian Satterthwaite to chief executive officer (CEO), and Tom Oberle to president. Founder and former CEO, Bob Brinkmann, will remain engaged as chairman of the board for the company he launched in 1984.

Since 2010, Bob Brinkmann had served as CEO, Satterthwaite as president and Oberle as executive vice president. Now 12 years later, Brinkmann Constructors’ annual sales revenue has grown more than ten-fold, rising from $111 million to $1.3 billion.

“It is an honor to succeed Bob as CEO,” Satterthwaite said. “He has put nearly four decades of dedicated effort into building an outstanding organization while generously planning a better future for all Brinkmann employee-owners via our stock ownership plan. We’re happy to have Bob’s involvement in nurturing the culture that defines us and his service as chairman of the board. Our community will benefit from his continued civic endeavors.”

The changes complete the last step in a multi-year leadership and ownership succession plan initiated by the founder. Ownership succession was addressed with the establishment of the Brinkmann Constructors Employee Stock Ownership Plan (ESOP).

“The outstanding performance and leadership shown by Brian and Tom have proven instrumental to our growth and success,” Brinkmann said. “I am excited to have them take full leadership of Brinkmann’s strategy, direction and operations while I remain involved as chairman of the board. I am confident they will continue to nurture our culture, which focuses on the strength of our team, the creativity and knowledge of our employee-owners, and the shared passion we have for serving one another, our clients and our communities.”

To further support growth, Ted Hoog, vice president of operations, was promoted to senior vice president of corporate operations, supporting Brinkmann’s national construction operations. Matt Funk, director of preconstruction, was named corporate vice president of business development and preconstruction, adding company-wide business development responsibilities to his existing duties leading Brinkmann’s preconstruction services.

Jeff Vierling, director of field operations, was named vice president of field operations, broadening his mentoring and management responsibilities for Brinkmann’s field teams nationally. Lucas Rottler, director of preconstruction in Denver, was promoted to vice president of preconstruction in Denver, expanding the scope of his responsibilities. Nathan Wirth, senior superintendent in St. Louis, was promoted to regional director of field operations in Kansas City.

The national construction firm today stands at 350 employee-owners scanning four cities (St. Louis, Denver, Kansas City and Richmond, Va.).

Brinkmann Constructors is a national general contractor offering design/build, design/assist and construction management services to a wide variety of commercial industries, including student housing, senior living, industrial, multifamily and mixed-use, office, retail and more.

________________________________-

Editor’s note: Catch Matt Funk as a panelist in MWM’s STL Mixed-Use Summit on Nov. 30 at The Expo at Forest Park. For more information, or to register for the event, CLICK HERE.

Trolley tour highlights what's next for Midtown STL

Midtown St. Louis establishments opening soon include a 10-screen, 45,000-SF Alamo Drafthouse movie theater and eatery, True Fusion gym, City Winery at City Foundry for “urban wine enthusiasts passionate about music,” and Puckshack minigolf. Alamo Drafthouse photo credit: MWM STL | Ruth Thaler-Carter.

Panelists sum up Chesterfield Valley comeback

Healthcare and senior living markets pivot to prosper

Despite continuing challenges in supply chain and workforce, the CRE market for healthcare and senior living projects in St. Louis remains healthy, thanks to some strategic pivots, according to panelists at the 2022 MetroWire Media Healthcare + Senior Living Summit, hosted by Brahms Construction (a Dover Companies business) in St. Louis, Mo. on September 27.

Kelly Reed, chief revenue officer with the Dover Companies, moderated the session, which featured insights from Matthew (Matt) Goebel, president, Brahms Construction; Adam Walter, vice president, Lument; Michelle Hamilton, business development director, Spellman Brady & Company; and Joseph (Joe) Lampe, director – healthcare, Cornerstone Commercial Realty.

Dover develops senior living communities; Brahms has 56 facilities in seven states; Spellman Brady is a women-business-enterprise/women-owned organization that works in design and artwork for senior living, education and healthcare entities; Lument is a commercial real estate lending bank exclusively serving hospitals and senior housing, and Cornerstone is a real estate brokerage working in healthcare only that serves five area hospitals and physician groups.

“The need for senior living communities is great, especially in under-served areas,” Reed said.

In asking for comments about the state of healthcare and senior living resources in the St. Louis market, Reed noted that “the adult child as a shopper for their parent” is a current trend. Virtual tours were a “great resource” during the pandemic and remain invaluable even post-Covid: “Customers might not have the opportunity to view facilities in person, so we had to shift and reinvent technology because these days, the customer experience begins online,” she said.

Businesses had to pivot as a result of the pandemic, Goebel said. “We engaged with third-party developers and are doing a lot more remodels from coast to coast because new buildings are not being built. Everyone is looking to refresh their properties.”

At Spellman Brady, “we were able to cross-populate projects and move more toward hospitality-based design,” Hamilton said. Requests for private space for healthcare staff to relax and rejuvenate themselves have increased, and expectations are that the baby boomer generation will need more senior facilities by 2030 as they retire.

“We’re seeing a lot of renovation work to elevate space to a higher quality and be more functional,” Hamilton said. “We’re designing for the next disaster to protect inhabitants, staff and visitors. It’s fascinating how we’re all borrowing (ideas and approaches) from each other.”

Panelists and their companies responded to the isolation of the pandemic in various ways, many of which were technology-based. “Technology expedited our ability to stay in touch,” Hamilton said.

“Capital solutions evolved during Covid,” said Walter. “We saw bridge loans as an opportunity for direct lending in acquisitions because many long-term owners wanted to exit the market. Owners were looking to diversify, which I expect to see as a strong continuing trend.”

The current environment is “an exciting time to be in healthcare real estate — we aim to lead clients into solutions,” Lampe said. “We were seeing increased confidence going into the pandemic that is continuing. It’s been a dogfight in private equity for physician practices. We’re now seeing much longer-term leases than I’ve ever seen before — 10 to 15 years.”

Current challenges include consumers paying more attention to how healthcare physical plants look and feel, Reed said, and that is driving design and renovation efforts.

Supply chain issues continue to bedevil the healthcare field.

“We’re getting product into town, but it’s still a challenge,” Hamilton said. “It requires earlier planning in acquisitions and greater care in setting budgets. Acquisition assistance is a big part of any new business. The main challenge is finding a balance between budget constraints and creating safe spaces. A lot of properties are prime for renovation.”

Reed noted that healthcare professionals have to be very careful about purchasing existing properties because “you never know what you’ll get”: A recent building acquisition came with more than 150 feral cats!

The pandemic era has had a positive impact on how clients respond to any continuing challenges and the occasional surprises: “People are being more flexible and understanding about delays and needing alternatives to their choices in materials or products,” Hamilton said.

The financial side of the healthcare real estate industry is having an impact as well. “A lot of clients have put projects on the back burner as interest rates have been going up,” Walter said. “They are waiting for the market to stabilize. From an operational standpoint, staffing is still a huge challenge. National compression over time is making it harder and harder to do some projects.”

Lampe is seeing a similar concern in working with landlords needing to fill or maintain commercial projects for healthcare entities as clients ask for space that responds to patient, staff and visitor requests for softer furnishings and less technical or industrial-seeming environments than in the past. “It’s hard to justify the return on investment on the atmosphere of your space,” he said. “If a building is visually detrimental, it can be hard to convince owners to upgrade it before they can sell. We have to make the case that, for instance, alarms might be out of code or a building will have unnecessary dedicated spaces that the owner will have to fix before anyone will buy.”

For the banking side of the healthcare industry, change is coming in the next six months. “A slowdown is coming,” Goebel said.

Panelists agreed that the pandemic has driven a greater understanding of the effect of a healthcare building on the physical and mental wellness of everyone who works, receives care or visits there.

“Design, art and furniture are things that people think about more from a biophilic or natural approach now,” Hamilton said. “We have to understand that demographic when we draw on colors and space. There’s also an increased demand for activities outdoors. We have to work closely together so design and products align with what patients and staff need.

This trend is also important from a practical perspective, she said: “If you don’t stay up to date, you can take a hit from Medicare.”

Walter alerted participants to building for the “active adult” as a new asset class — a product developed in 2016 but becoming increasingly popular in healthcare communities today.

“These are essentially age-restricted — 55-plus — rental properties with an amenity-rich lifestyle focused on wellness,” he said. The average age of the active adult is 72 to 74, compared to 80 and older for traditional senior living communities. That demographic is a factor in whether to build on an existing campus or build something new, he said.

According to Lampe, “we are seeing demand for more space in waiting rooms and larger areas for receptionists and other staff. How common areas feel is more and more important.”

Goebel noted that when thinking about the wellness factor, “it is critical for everyone to know that construction is a very stressful environment. It’s the largest industry with mental health issues because it’s such a push-push industry with constant deadlines.”

Asked about the biggest deals in the St. Louis healthcare market, Lampe listed the BJC vascular center, Mercy Health Creve Coeur projects and Mercy South Cancer Center and an upcoming Kindred Healthcare site.

“There are also a lot of smaller deals,” he said. “The last two years have been the busiest I’ve ever seen in that arena, and there will be continued ripple effects in independent practices.”

Goebel expects St. Charles County to see substantial growth in healthcare facilities.

Altogether, panelists agreed that the St. Louis healthcare market is doing well and should see continued growth and expansion, with ever-increasing attention paid to the way commercial properties support the physical, mental and emotional needs of all user demographics.

Bluff City Outdoors opens state-of-the-art archery center

The Riverbend area has a new, exciting hangout for hunting and fishing enthusiasts to share stories, purchase necessities and equipment, and now even practice their skills.

Bluff City Outdoors, a staple in the Alton, Mo. community and conveniently located along the Mississippi River, is where both Illinois and Missouri residents alike gather supplies for the day when heading out on their next big adventure.

What once was a small tackle shop, is now grounds for outdoorsmen of all types. Owners of Bluff City Outdoors, Mark and Felecia McMurray, have continued to grow the footprint over the last year by building an addition to the existing store, creating the first and only archery range seen in the area in many years. Not only does the new facility bring archery back to Alton, but it does so with the newest products and technology.

Bluff City Outdoors’ new bow shop is an authorized dealer of Hoyt, Mathews, and Ten Point brands. The range itself includes a Techno Hunt video system, a 3D target range, and even a paper target range for traditionalists. There are limited targets available for crossbows. The archery department will be headed up by Jeff Dickinson who was the lead bow technician at Town Hall Archery before it closed this past January.

Welling Construction recently completed the new 8,000-SF addition to house the archery range. The range has been officially open for the last two weeks and leagues are beginning to form. “We are forming 2-person and 4-person leagues for both the Techno Hunt and 3D target ranges,” said McMurray.

The business also plans to host open 3D target events. Information on these leagues can be found by following the Bluff City Outdoors Facebook page.

“We believe we have created the best archery shooting facility in the St. Louis area. We have a state-of-the-art Techno Hunt system and a configurable range of up to 40 yards. This is another step on our path to create the best outdoors store in the region," McMurray said.

A grand opening celebration is scheduled for September 17, 2022; the public is invited to stop in at any time and check out the new facility.

Inquiries about Bluff City Outdoors or the newly forming leagues can be directed to Mark at (618) 465-6175 or mark@bluffcitytackle.com.

More information can be found at www.bluffcityoutdoors.com.

Start-ups, geospatial among key factors in economic growth for St. Louis

Nu Way expands to meet surging rebar demand

Feature photo: Nu Way Companies has broken ground on a new fabrication facility that will more than quadruple its annual tonnage of fabricated rebar. The new 35,000-square-foot fabrication facility being built by Contegra Construction will allow them to produce 15,000 tons annually. Photo courtesy of Contegra.