The St. Louis chapter of the Urban Land Institute (ULI) hosted its first event of the year at the city’s newest entertainment venue, Armory STL, where attendees learned about the "2023 Emerging Trends in Real Estate" from both national and local ULI representatives.

The fully restored venue represented one of the very trends that the ULI focuses on in its annual trends report, according to Aaron Williams, board of directors member of Northside Community Housing, Inc. and ULI-STL District Council chair, who noted: “changes in uses as a number of projects are finding a higher purpose in the cool conversions of existing buildings.”

According to Byron Carlock, national partner, and real estate practice leader for PricewaterhouseCoopers (PwC), “this building personifies everything we’re about.”

Carlock said the top 10 trends for this year are:

Normalizing

… Still, We've Changed Some

Capital Moving to the Sidelines — or to Other Assets

Too Much for Too Many

Give Me Quality, Give Me Niche

Finding a Higher Purpose

Rewards — and Growing Pains — in the Sun Belt

Smarter, Fairer Cities through Infrastructure Spending

Climate Change’s Growing Impact on Real Estate

Action through Regulation

He noted that a recent downturn “ain’t our fault” but is “driven from a top-down federal slowdown” and the triple increase in interest rates.

Carlock’s presence was especially appreciated because he almost didn’t get to St. Louis, thanks to flight delays and changes caused by the FAA system glitch on the morning of the event. “It seems like there’s something chaotic every day,” he said.

Despite such issues, though, “there are tons of opportunities among those looking to revitalize buildings and communities,” Carlock said. “Market sentiments reflect concerns about inflation, housing, supply chain disruptions, but the reality is that in our business, we run in cycles. We are normalizing now, but it could be slow and get messy.”

Issues include inflation at a 40-year high, so “we’re not seeing a lot of transactions. We’re in for a bit of re-pricing. Among the notable changes, shoppers are going back to stores (in person), the value of face-to-face is being rediscovered, employees like flexibility (of combining working from home with back to the office) and employers want collaboration — the magic number seems to be three days a week in the office.”

Energy-Social-Governance (ESG) aspects are “a delineator between whether the office is relevant or not, and is a real issue,” Carlock said. “The bigger question is which buildings are worth keeping as is versus being repurposed or torn down altogether.”

For the St. Louis area, the number-one commercial real estate sector is industrial, followed by multifamily as “people are moving to a population that prefers to rent versus own.” Hotels are third, single-family homes fourth, retail fifth and evolving demand for office space is sixth.

“Coastal markets did not do well” in 2022, Carlock said, while St. Louis saw “a proliferation of activity in life sciences, technology and innovation.”

In the capital markets, “bankers are not returning our phone calls. We have to wait and see (on project lending) — it is not a full retreat. We are not seeing very many work out because there’s too much equity. Some developers are walking away (from projects) because they can’t pay the interest or debt.”

Non-bank banks, however, are doing “really well,” according to Carlock. “New offices are also doing quite well, especially buildings that offer the best ESG, technology and security.”

Carlock cited reuse as a solution to multiple challenges. He suggested targeting office-to-residential, hotel-to-residential and retail-to-distribution as ideal opportunities for the new year.

“The challenge is there are no cookie-cutter solutions. Each building will need a new approach,” he said.

Labor remains a major concern, but increased immigration should help in that area.

“If the trends seem familiar, it’s because they are — they remain important,” Carlock noted. “Climate risks will need a proactive approach. The best operators will be those who differentiate themselves. We should come out better on the other side.”

An important factor for commercial real estate success in St. Louis is that “there is so much philanthropic support,” Carlock concluded.

That aspect was noticeable as Kacey Cordes, ULI STL Governance chair and vice president, U.S. Bancorp Community Development Corporation, whipped through a laundry list of “40 reasons for optimism in St. Louis.” These include “21c Museum Hotel brings the art, City Stadium unveils its pitch, Pillars of the Valley inspires along Market (Street), stadium hotels catalyzed next door (to the new soccer stadium), Zoo expansion sends animals to North County, the Riverfront gets the redevelopment attention it deserves, Target on Grand [is] a shot in the arm for St. Louis University, City Foundry expands to Vandeventer, the Armory STL serves up all the games, MLK Cultural Boulevard imagines a revitalized corridor, Chesterfield downtown comes to life, Sado leads a restaurant resurgence and the Jefferson Connector actually does just that.”

Cordes said she also expects important commercial activity and progress as “Midwest Climate Collaborative raises awareness, Brentwood Bound remakes a flood zone with resilient public space, new public sector leadership cleans the slate, NGA inches closer to completion, Washington University Medical Center keeps building … and building, SLSO expands its first-class operation, Clayton [sees] first new hotels in decades, and the St. Louis University Hospital outpatient clinic shares a beacon of health.”

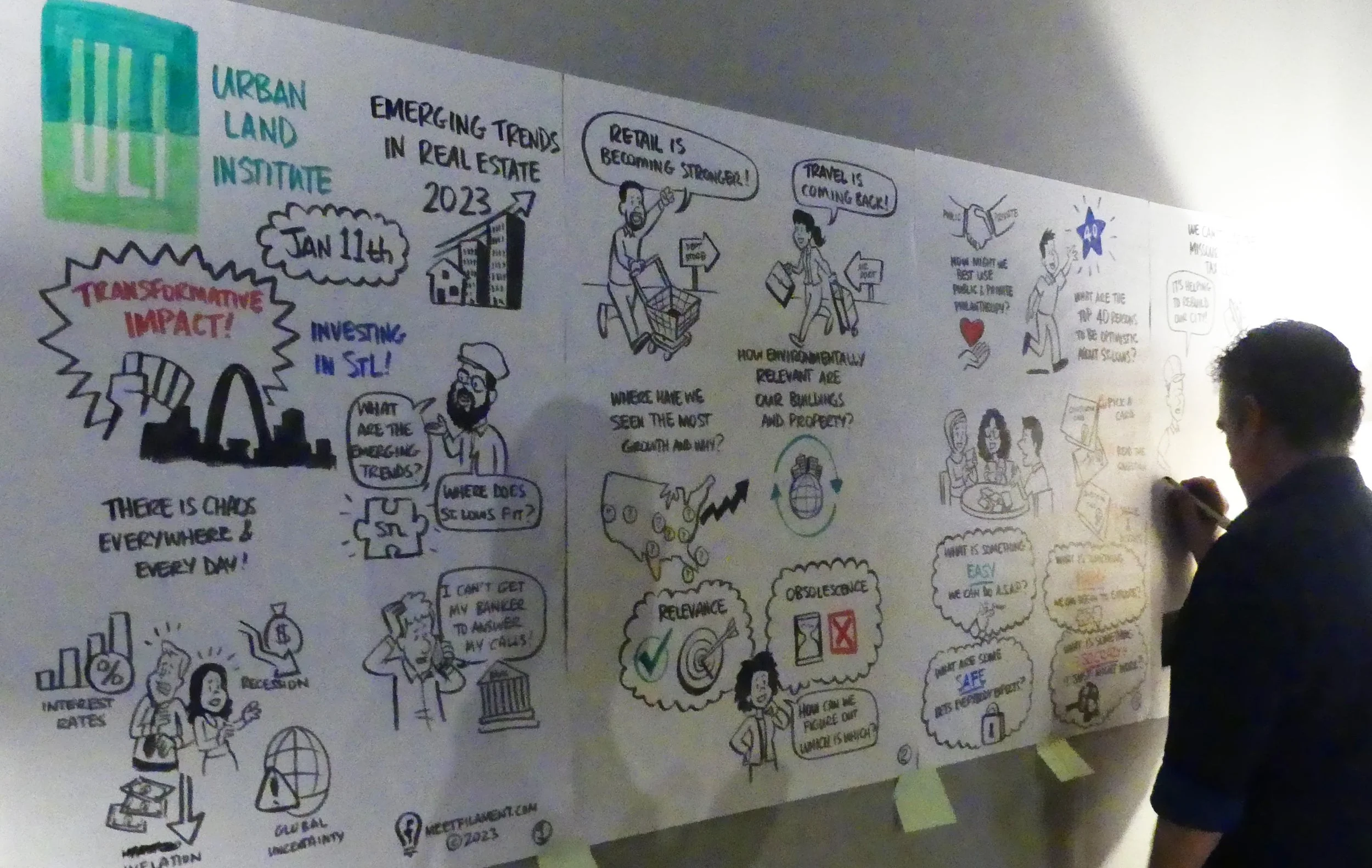

Matt Homan, founder and CEO, Filament, led participants through interactive exercises aimed at both enhancing networking and generating ideas for how commercial real estate professionals could contribute to better projects and environments. He had attendees move to different tables and discuss projects they’ve seen succeed in other cities that could be effective in St. Louis. Adaptive reuse, expanded marketing and outreach beyond city/county borders, and increased reliance on understanding and using data seemed to lead the field of ideas.

______________________________________________

FEATURE PHOTO: Throughout the ULI program, Todd Bauman, lead artist and visual recorder with Filament, caught the attention of participants as he sketched the comments and insights of presenters on a storyboard. Photo credit MWM STL | Ruth E. Thaler-Carter