According to Chris Kuehl, managing partner and co-founder of Armada Corporate Intelligence, economists routinely predict things to be worse than they will be.

“If you suggest you are on the edge of recession and then you don’t hit a recession, everybody is happy,” he said.

Kuehl outlined some of his observations about the economy during a virtual presentation last week hosted by CCIM Kansas City.

Kuehl said the economic forecast for 2023 and 2024 missed the mark by approximately one-half point.

“We’ve been doing consistently better than the initial predictions,” he said.

Consumer spending, which drives 76 percent of the United States’ gross domestic product (GDP), has spurred the strong economy. Stock market gains boosted consumer spending.

“We’ve seen $900 billion in new stock wealth created, which is staggering,” Kuehl said.

The stock wealth has resulted in an estimated $288 billion in additional spending, creating a $1.3 trillion economic multiplier.

Not everyone views the economy as strong. Kuehl noted that the “radically different interpretations” about how the economy is doing are because of a rare K-shaped recovery. Those in the upper one-third (households making $100,000 or more) barely notice inflation.

“They’re buying cars and houses and recreational vehicles and all that stuff, and that is the multiplier effect. They are spending money on something that supports whole industries,” he said.

The lower third of households (those making less than $50,000) is living paycheck to paycheck and finding it more difficult under the weight of inflation. The third in the middle is holding its own as long as their jobs remain secure.

“So the economy is roaring along better than thought growth, but it’s fragile because everything hinges on the middle hanging on and the upper income continuing to spend,” said Kuehl.

Kuehl said although the rate of inflation is declining, it takes a long time for it to come down once it has risen. The two factors that can drive down inflation are a full-blown depression or competitive pressure. According to Kuehl, much of the U.S. economy is not all that competitive, with much of the competition coming from outside of the United States.

The Federal Reserve forecasts that GDP growth will rise to about 2.1 percent. Kuehl noted, however, that Scott Bessent, the newly confirmed Treasury Secretary, is targeting growth at three percent.

“So if we end up with growth even just shy of three percent, that’s pretty respectable. Our average of the last 25 years has been 2.5,” Kuehl said.

The Fed also projects that unemployment will remain stable, if not fall. Kuehl said the workforce shortage has resulted in wage growth which is fueling inflation. Historically, wage growth has been 2.5 to three percent. Currently, it’s growing at closer to 3.5 to four percent. Those making higher wages are in great shape, but households in the lower third have no leverage, he said.

Kuehl said the Fed funds rate likely will remain steady---4.4 percent this year.

Kuehl said inventory to sales ratios in most sectors are close to balanced, having recovered from the supply chain issues during the pandemic.

On a national level, nonresidential construction is still growing at a rapid rate, and even shifting a little. While much of this growth was driven for a while by warehousing and logistics support, there now is increasing development in projects like data centers.

“You’re seeing a lot of development in energy just to support the expected growth of data centers. This country is going to need to add 44 terawatts of energy production in just the next four to five years. That is mammoth. If you think you’ve seen a change in energy, you’ve not seen anything yet. The idea now is that everything is up for grabs—oil, gas, coal, solar, wind. Nuclear is going to be making a huge comeback in the next two or three years. Hamsters on wheels are probably going to be out there at some point. We need energy. We’re going to need lots of it,” said Kuehl.

The United States now is “North American independent” on oil and gas. It is the world’s largest oil exporter, and it no longer buys any from the Middle East or North Africa.

“Our production is very high. We’ve never produced this much. All-time highs,” said Kuehl.

Kuehl said office buildings are making a comeback--although not as big as they once were--with the movement to return to the office. In addition, residential construction is growing.

Kuehl said corporate investment, particularly in technology, is steady.

The tariff issue also is looming. Kuehl said the problem with tariffs (which he termed as a “tax”) is that they work only if there is a competitive market. If the United States does not make the item being imposed with a tariff, it’s not going to change the price. But, tariffs can be used to strengthen the industrial sector.

“We can use a tariff to encourage consumers to buy more expensive things that are produced here,” he said.

Reshoring is real, Kuehl said. There still are many companies coming back to the United States, and 80 percent of the jobs that are being created are in the south or the Midwest. He said Kansas City is really well-positioned, but it needs to be more aggressive about competing for the industrial projects.

“The three things that are making Kansas City competitive: One is transportation. The merger of Canadian Pacific and Kansas City Southern (CPKC) is huge because that’s a north south route that really hadn’t existed before. It really unites the Mexican industrial sector with the U.S. and Canada. That’s already attracted a lot of business interests to this region. Number two is that we have a better than average workforce situation. We have more training centers. We have more community colleges. . . . We’re pretty well fixed compared to many other states. The third thing that makes this area popular is just simply distance. No matter what side of the U.S. you come in on, the middle is easier to attract, and that’s been paying off. But, we have to be better at extolling our virtues,” he said.

The prominence of the Kansas City Chiefs also has helped put Kansas City on companies’ radar.

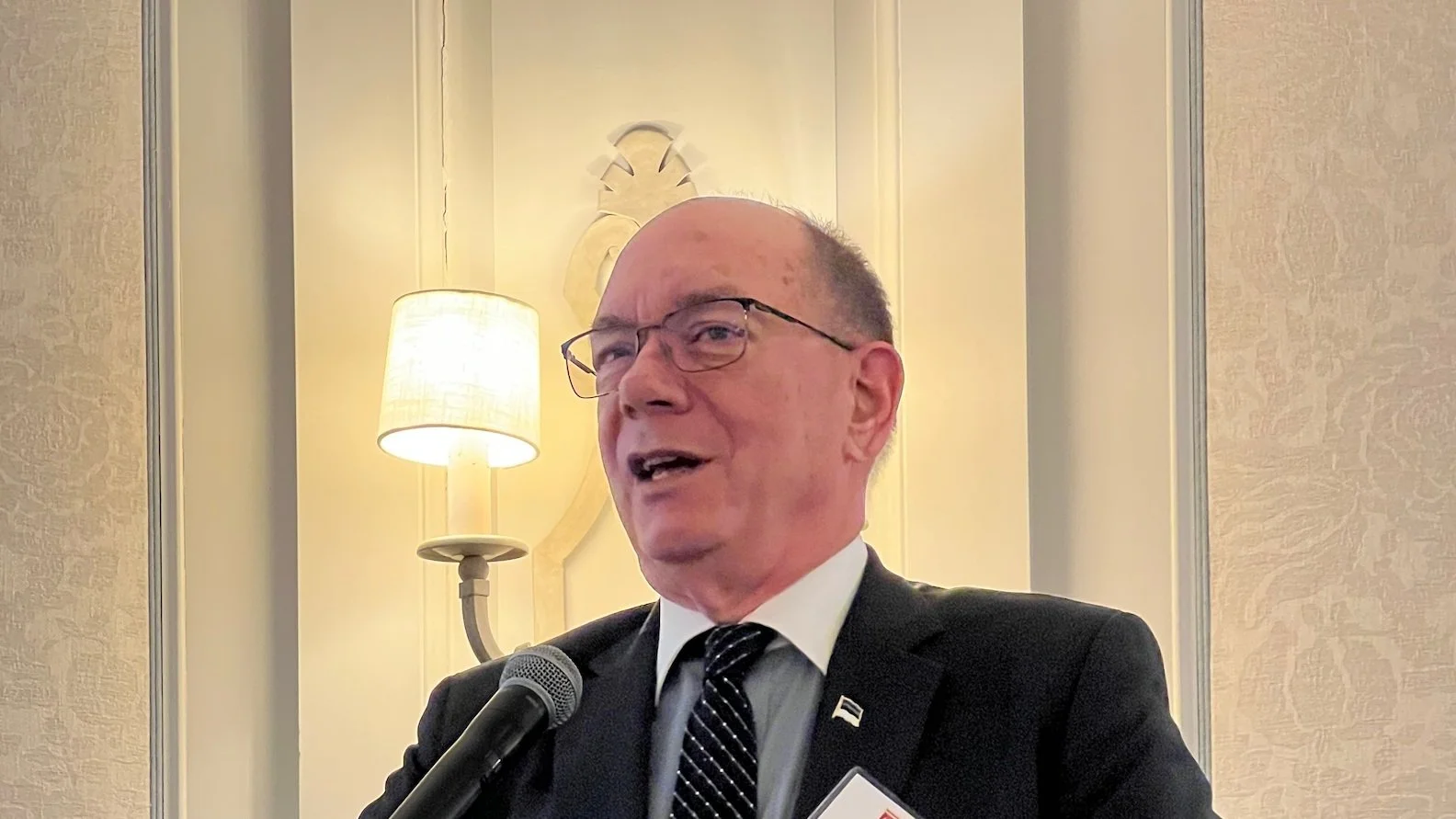

Above: Dr. Chris Kuehl is a Managing Partner of Armada Corporate Intelligence and top economist keynote speaker. Image courtesy of American Supply Association